Trending Articles

Trending Articles

-

The History Of Japanese Luxury Watch Brand Grand Seiko

21 Aug, 20230

Featured Video

Featured Video

A Collector’s Delight — Arnold & Son Time Pyramid

READ FULL STORYRecent years have witnessed a remarkable shift in the horological landscape, as pre-owned watches have surged in demand, eclipsing even the allure of brand-new creations. Even amid the pandemic, when the sales of new watches staggered, pre-owned watches stood tall, boasting a consistent demand that has only grown since then.

This unprecedented trend prompts a probing question: what could be driving this skyrocketing interest in pre-owned watches? Spurred by this question, we took it upon ourselves to investigate this remarkable phenomenon. Backed by statistics from recent reports that delve into what makes the customer go for a pre-owned piece over a brand-new model, here are our findings.

5 Reasons Why People Are Buying Pre-owned Watches

1. Financial Compatibility

Let us be honest: luxury timepieces are not precisely that financially viable. The more intricate a mechanism or complications, the higher the price point it is bound to have. So, pre-owned pieces offer the perfect way to overcome this challenge, offering a more affordable entry point into the world of luxury horology. So much so that 48% of the respondents of a recent study by Deloitte cited their affordability as the reason they go for pre-owned watches rather than brand-new ones, a 4% rise from 2022 (Deloitte, 2023). With the opportunity to own a luxury piece for a significantly lower price, such watches certainly present an attractive proposition for the cost-conscious watch connoisseur.

2. Investment Purposes

The allure of pre-owned watches as investments have intensified in recent years. According to the same Deloitte report, 21% of buyers saw these timepieces as a worthy investment in 2022, and this figure saw a notable uptick to 24% in 2023. Notably, a substantial majority of these buyers, exceeding 30% in 2023, considered these acquisitions as a means to diversify their investment portfolios.

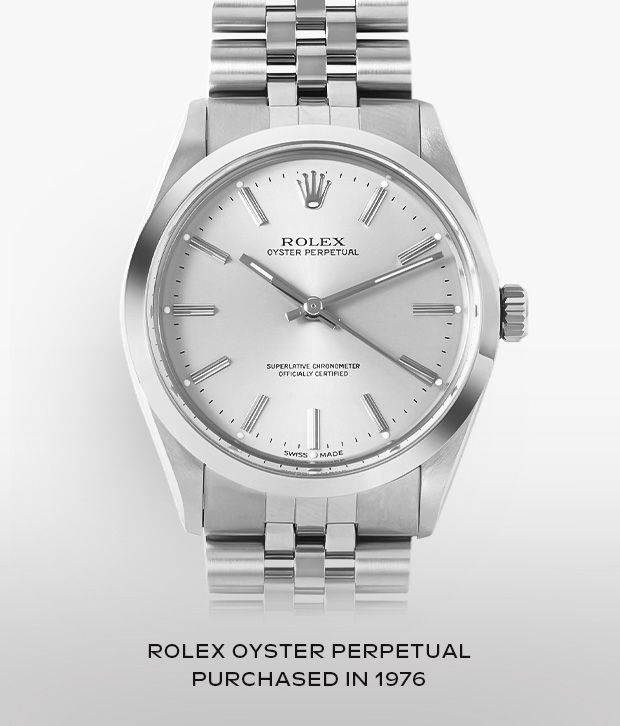

The remarkable appreciation in the value of pre-owned watches, particularly top models from prestigious brands such as Rolex, Patek Philippe, and Audemars Piguet, further brings this point home. As per the findings of Boston Consulting Group (BCG), an impressive annual growth rate of 20% between August 2018 and January 2023 was observed. This performance outshone broader market indices, with the S&P 500 yielding a modest 8% annual rate of return during the same period.

The S&P 500 index, or the Standard and Poor’s 500 Index, is a stock market tracking index that monitors the changing equity of 500 major companies that are listed on the US Stock Exchange. And this considerably massive growth on the index shows that even in the midst of economic downturns triggered by the pandemic, pre-owned watches demonstrated resilience. This is especially prevalent when compared to the resilience of stocks in the same period, further endearing them to investors.

The Deloitte report further reported that apart from investments for diversifying the portfolio, an additional 30% of buyers bought pre-owned watches to hedge against inflation and for future resale. Similarly, 10% envisioned these timepieces as worthy of becoming cherished family heirlooms, connecting the past and future generations through the intricate art that is luxury watches (Deloitte, 2023, p. 37).

3. Ability To Secure Rare And Discontinued Models

A significant contingent of collectors and enthusiasts gravitate towards pre-owned watches due to the allure of discontinued models and limited or special editions. As per the Deloitte study, 31% of buyers were specifically seeking to get their hands on discontinued models in 2023, representing a modest increase from the 29% recorded in 2022.

Furthermore, the same report noted that sales figures for pre-owned rare, limited edition, or special event models stood at 21% in 2023, highlighting a sustained fascination for exclusive timepieces created to commemorate significant occasions. This trend relates seamlessly with the growing affinity for vintage objects, particularly among younger generations who are eager to acquire items that exude a sense of uniqueness, history, and the charm of the times gone by.

Some rare gems from the Second Movement….

4. Concern For The Environment

Another trend common among the youth today that has catapulted the status and affluence of pre-owned watches is the aspect of sustainability and concern for the well-being of the environment. Specifically, the percentage of buyers choosing pre-owned watches for sustainability reasons increased from 21% in 2022 to 23% in 2023, as reported by Deloitte.

Although small, this increase in purchases made for this reason signifies the commitment to do better for future generations. With the younger generation becoming increasingly more sustainable in their daily choices as compared to the previous generations, sales of pre-owned watches for this reason can be anticipated to increase even further in the future.

5. No Time Spent on the Waitlist

Waiting is always the most challenging part when you buy something you fall in love with at first sight. Even more so when it is a piece of art as intricate as a luxury Swiss timepiece, this is where pre-owned pieces come in handy. In an era of instant access and convenience, pre-owned watches provide an appealing solution for those who wish to acquire a coveted piece without enduring the often lengthy wait associated with ordering a new watch. So much so that, as per the findings reported by Deloitte, it has become the key reason for investing in pre-owned pieces for 24% of the respondents in 2023, as opposed to 21% in 2022.

In Conclusion

Within this evolving landscape, it’s essential to recognise the pre-owned segment’s growing significance within the luxury watch market, which represented a $79 billion market in 2022. With this value expected to reach a massive $101 billion by 2026, $35 billion of it is attributed to the sales of pre-owned watches. Hence, it underscores the remarkable ascendance of second-hand watches as an influential force within the realm of luxury timekeeping.

The Journal

Want to be the first to be in the know?

Sign up to be emailed when I publish new content. Read. Watch. Shop. Learn. Trade. All in one place.

Conversation 0 comments